Blog/CRM/Why Brands Need to Fortify CRM in China in 2025?

As Chinese consumers crave personalized experiences more than ever before, with a staggering 84% expressing willingness to share data for this purpose (PwC), brands in China face mounting pressure to bolster their Customer relationship management (CRM) strategies.

But why now? Can enterprises simply apply successful global practices to the Chinese market? What sets CRM in China apart?

In this article, explore the unique nuances of CRM implementation in China, understand the imperative for brands to strengthen their CRM efforts to stay competitive, and discover why Salesforce China emerges as the optimal solution.

Table of Contents

What is Customer Relationship Management (CRM)?

CRM is a technology that enables companies to manage their relationships and interactions with various stakeholders, especially leads and customers.

By centralizing customer data from multiple (if not all) physical and digital touchpoints, CRM allows brands to segment and analyze data to gain insights for future engagement strategies. This helps businesses streamline processes for maintaining connections and enhancing personalization to nurture leads and customers toward conversions or repeat purchases. Ultimately, CRM aims to improve profitability and customer lifetime value (LTV).

However, is CRM the same everywhere?

CRM in Global Markets vs CRM in China

CRM in Global Markets

In global markets, besides primary online brand channels like websites and popular social media platforms (e.g., Facebook, YouTube, Instagram), emails, Whatsapp, and SMS remain pivotal communication channels between brands and customers.

In fact, Statista (2024) reveals a consistent increase in the daily exchange of emails worldwide over the years. Email marketing was expected to generate over $10 billion in revenue by 2023 and the global email user base is projected to reach 4.6 billion by 2025. What’s more, the mobile-centric trend also extends to emails, with 46% of smartphone users preferring to open emails via mobile devices.

As a result, global CRM solutions are primarily tailored to facilitate maximum engagement across these channels. Ongoing trends such as hyper-personalization and the integration of AI and automation further drive the adoption of CRM platforms across industries. They are designed to support marketing, sales, and customer service functions, enabling brands to forge stronger connections with customers.

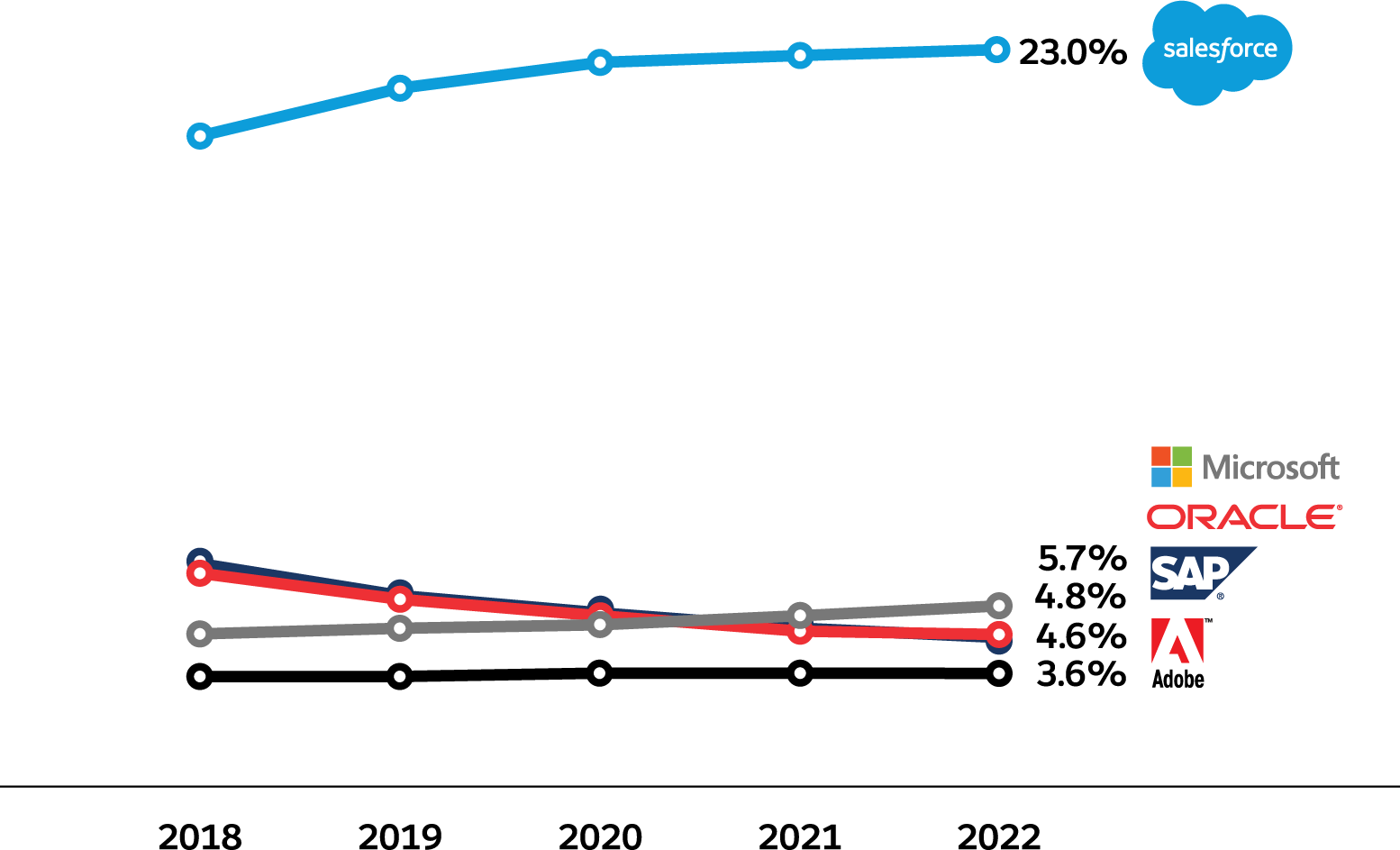

According to IDC, Salesforce is currently leading the worldwide CRM market with a 23% market share, significantly surpassing competitors like Microsoft, Oracle, SAP, and Adobe. Through its Customer 360 solution suite, Salesforce unifies sales, service, marketing, eCommerce, and IT teams, providing a shared and comprehensive view of customer profiles to enable customer-centric operations.

China Digital Landscape & CRM China

Many businesses operating in China for years may still lack a solid grasp of the country's digital landscape. This landscape is dominated by the "BATB" quartet - Baidu , Alibaba, Tencent, and ByteDance – commanding the lion's share of user attention.

While initially mirroring their Western counterparts (Google, Amazon, Facebook), these giants have evolved into "super-apps" offering a plethora of services, from social networking and eCommerce to search, entertainment, and more, driving the "social commerce" trend to new heights.

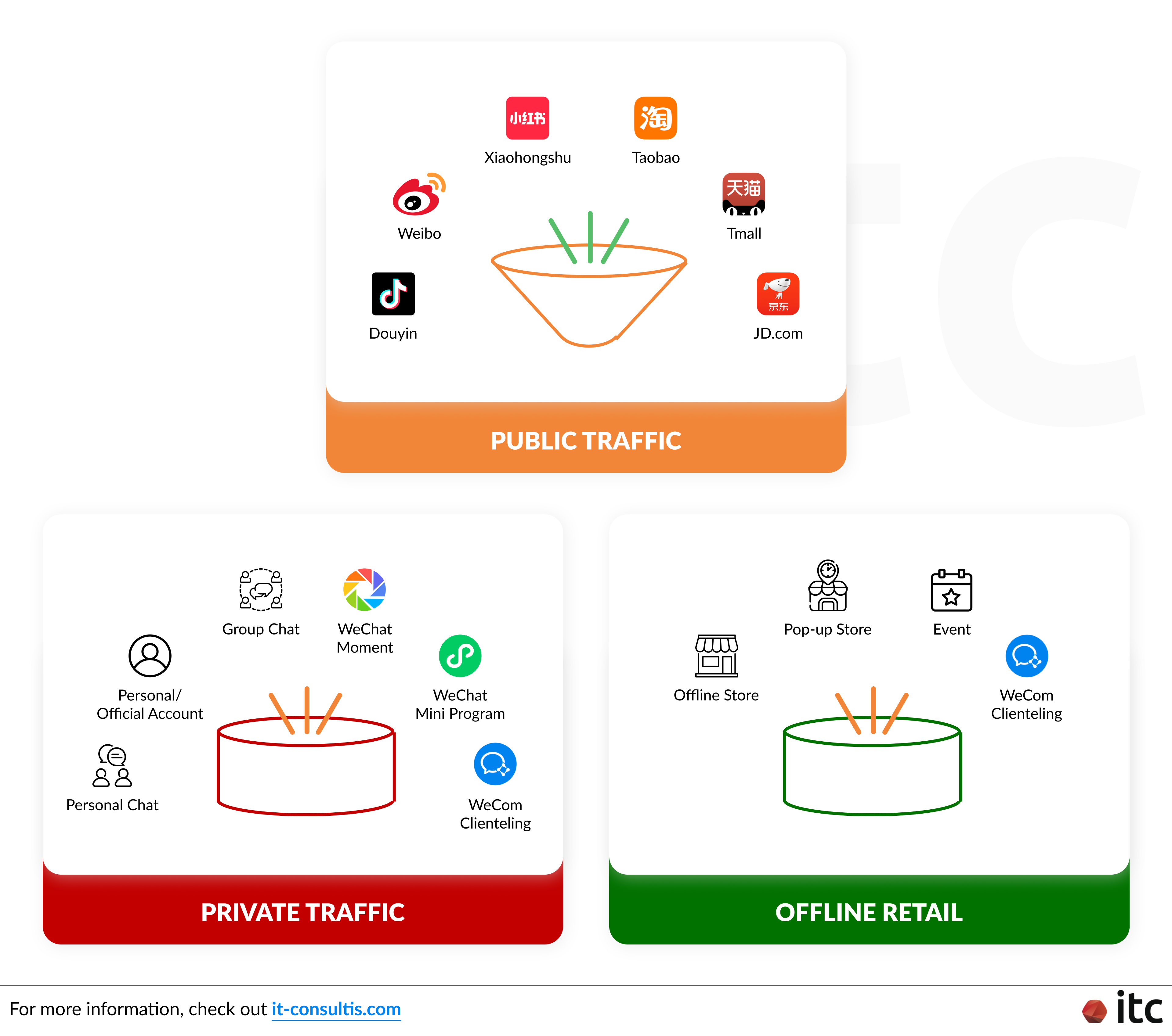

One crucial distinction lies in the user traffic between different ecosystems, termed as "public traffic" and "private traffic".

- Public traffic domains encompass public marketplaces (e.g., Tmall, JD.com) and platforms (e.g., RED/Xiaohongshu, Douyin, Pinduoduo), offering great exposure and campaign opportunities for brands but with soaring customer acquisition costs and data ownership challenges. This is because user data belongs to the platforms instead of the businesses.

- Private traffic domains refer to brand-owned channels like WeChat Official Accounts, Mini Programs, websites, and WeCom clienteling, granting brands full control over customer data. This approach is increasingly vital for brands in China to deploy more direct-to-consumer (DTC) and personalized engagement strategies.

As social commerce becomes the new normal in China, Marketing Automation and Social CRM tools are playing a vital role in data consolidation for key channels, such as WeChat and Tmall. Additionally, there's increasing interconnection among tech giants, facilitating the flow of data beyond their respective ecosystems.

For instance, Alibaba's Tmall now features a chat function allowing Customer Service operators to communicate directly with customers on Tencent's WeChat.

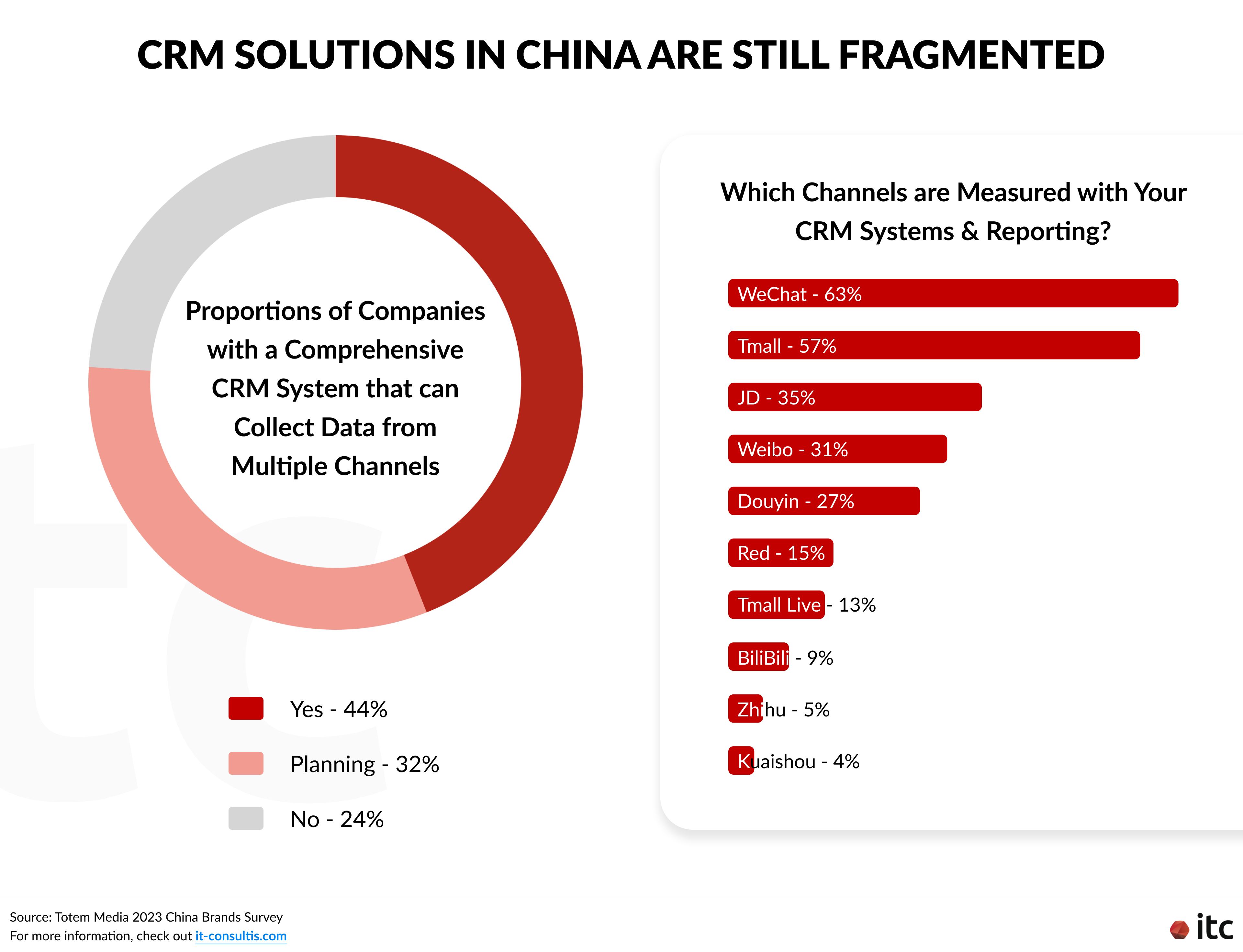

Despite these advancements, brands have yet to fully embrace a comprehensive centralized CRM China system to merge all data flows across different channels.

Moreover, local data regulations such as the China Personal Information Protection Law (PIPL) present considerable obstacles – more daunting than GDPR in the West – for managing data processing and cross-border transfers to brands' global CRM systems. This is particularly challenging for luxury brands serving jet-setting Chinese clientele with a strong appetite for personalized experiences across global markets.

Why Brands Need to Fortify CRM in China

As previously mentioned, despite leading in various digital transformation areas, China lags behind in the CRM aspect due to significant fragmentation. Brands often lack a unified CRM solution for tracking data across all channels.

Additionally, major public traffic platforms tightly control data access with limited API access. Consequently, brands typically have to rely on each channel’s proprietary dashboards or systems for customer insights (Totem 2023 China Marketing & Media Trends).

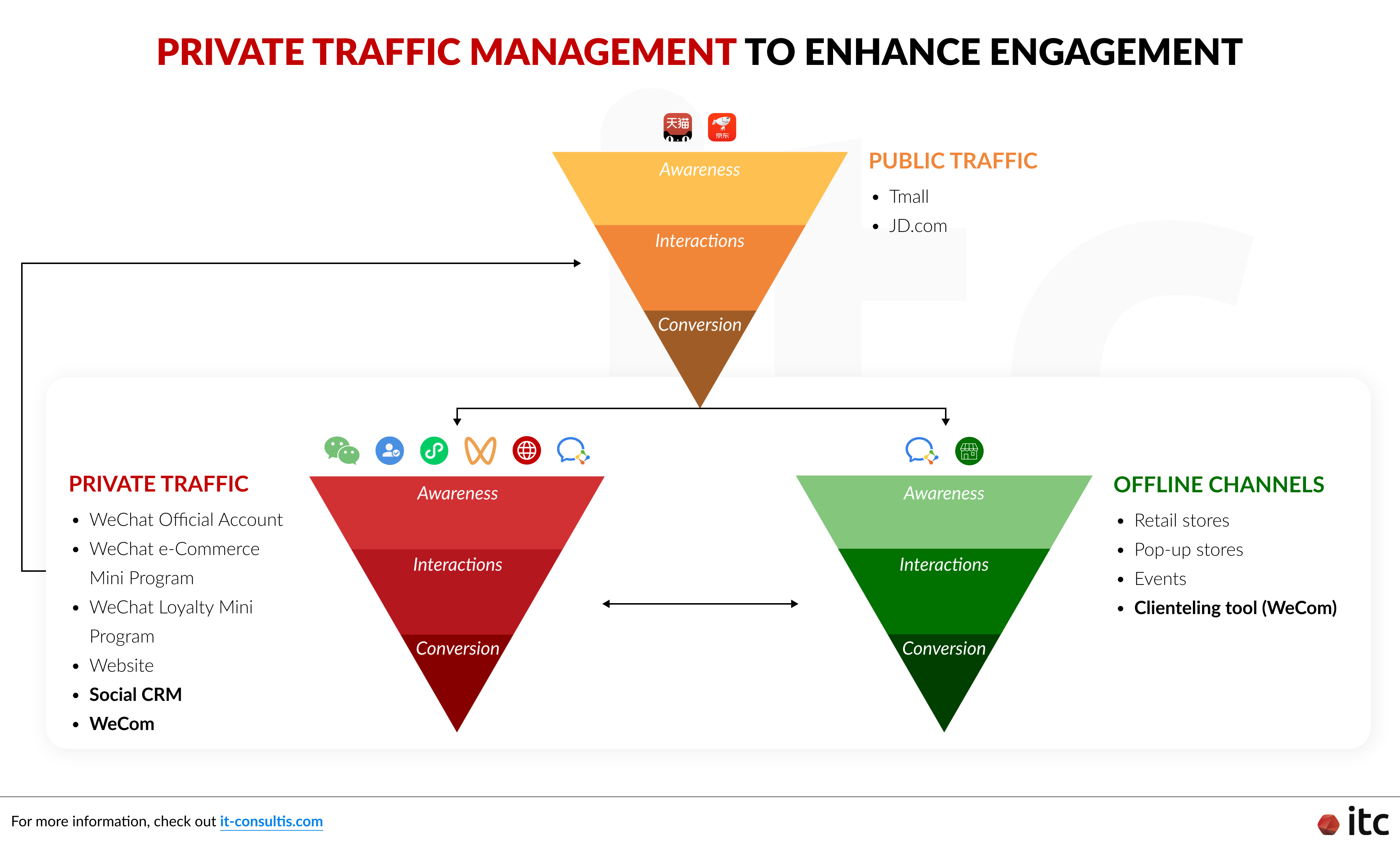

Therefore, to tackle these data challenges, private traffic management is an excellent initial step for CRM China. Here, brands can retain complete ownership and control over customer data and interactions.

From engaging followers through compelling content on WeChat Official Accounts, providing VIP services via eCommerce and loyalty Mini Programs, and utilizing WeCom for clienteling, WeChat is the most important channel for private traffic and CRM operations, especially for luxury brands (Salesforce & Totem China Trend Report: Insights for Luxury Brands – 2023).

By leveraging Social CRM integration with WeChat, the tool can serve as the conveyor belt that consolidates various scattered digital assets, including eCommerce data, loyalty information, direct input from Sales Associates via WeCom, and user behaviors on WeChat Official Accounts.

Moreover, private traffic management can significantly support offline channels by facilitating online-to-offline (O2O) traffic flow (and vice versa) and empowering offline clienteling.

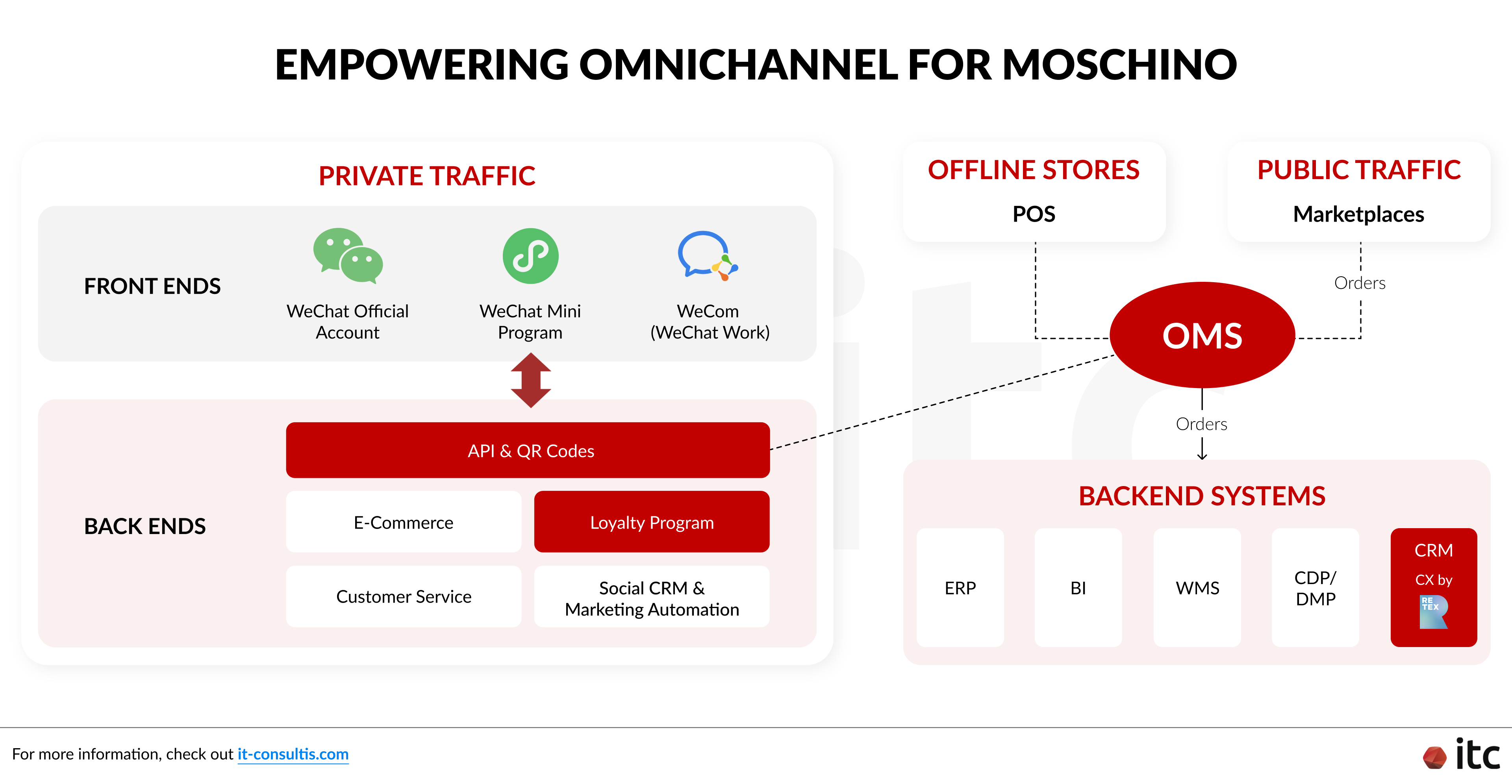

Below is an example of how Moschino enhances its omnichannel presence by focusing on private traffic areas. By leveraging Marketing Automation and Social CRM, Moschino builds a closed-loop data ecosystem in China.

This system effectively links its WeChat loyalty Mini Program, online and retail WeCom clienteling system, and WeChat Official Account together and with other China business systems. On top of this, Moschino is using Venistar CX (Commerce eXperience) by Retex spA as its CRM system.

Starting with private traffic management, brands can progress to deploy a comprehensive China CRM strategy, enabling the creation of a holistic 360-degree view of customer profiles across all channels, both online and offline. These robust customer insights can drive enhanced product, service, and experience personalization, leading to increased engagement, revenue, and loyalty.

Strategy for Comprehensive CRM in China

Here are four key strategic pillars for developing a holistic CRM strategy in China:

- Data-driven personalization: Segment consumers based on demographic and behavioral traits, then tailor personalized content and experiences to match individual preferences and needs.

- Consolidated touchpoints: Consolidate data from various sources to create a complete view of customers that empower all customer operations, ensuring consistent messaging and offers across online and offline touchpoints (e.g., Mini Programs, social media, in-store) to boost brand awareness.

- Consumer education and value proposition reinforcement: Use interactive content such as testimonials and brand stories to enhance customer understanding of products and reinforce unique selling points and brand positioning.

- Predictive analytics and Marketing Automation-empowered proactive engagement: Utilize Marketing Automation tools to analyze consumer behaviors (e.g., browsing history, post interactions) and target consumers more effectively, driving both revenue and loyalty through proactive engagement.

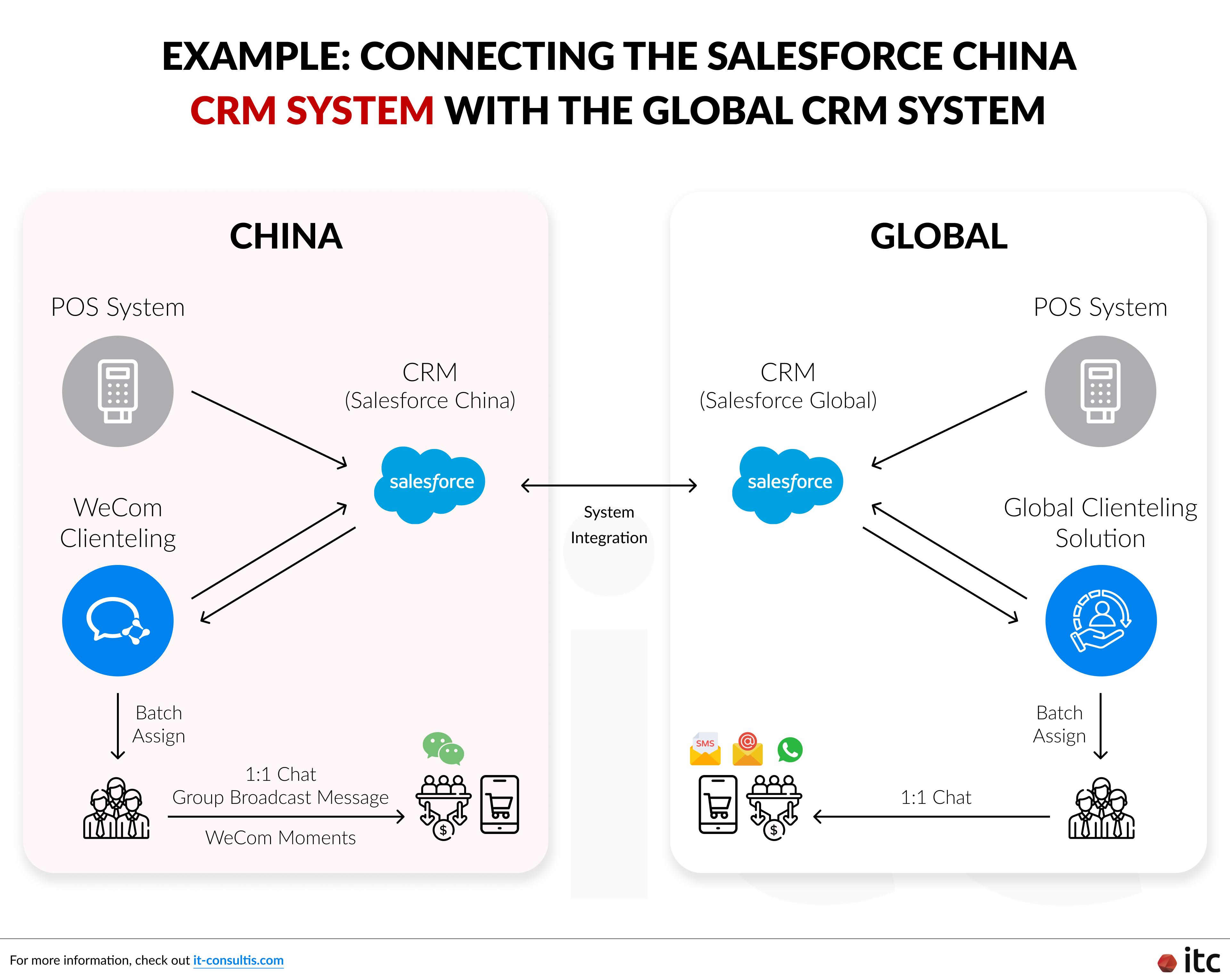

Additionally, to ensure compliance with local data regulations, brands must host and process data captured from China within the country before integrating it with their global CRM systems.

Here's what the general CRM structure with Marketing Automation capability would look like:

Salesforce China: Is the Right CRM in China?

As mentioned earlier, Salesforce is recognized as the world's leading CRM solution. However, its entry into the Chinese market, in partnership with Alibaba, occurred relatively recently, particularly towards the end of 2023, marked by the introduction of the localized Customer 360 solution.

Given China's unique technological landscape, regulatory challenges, and market dynamics, Salesforce China has been tailored to the local market to:

- Meet evolving market demands by integrating with local data analytics, consumer insights tools, and Marketing Automation solutions

- Ensure compliance with local residency regulations by hosting data on Alibaba Cloud, ensuring that Chinese data remains stored and processed within China

- Facilitate seamless integration between local and global tech ecosystems, including CRM systems

- Empower local customer engagement platforms such as WeCom clienteling, customer service, eCommerce, and WeChat Official Accounts

- Enhance performance and accessibility through AliCloud's secure and compliant cloud infrastructure

While Salesforce products have been present in China for years, primarily focusing on Marketing Automation and eCommerce, they initially faced stiff competition from more powerful Chinese sCRM solutions. However, over time, Salesforce has closed the gap by enhancing its functionalities.

With the full integration of these systems into the newly introduced Salesforce CRM China, brands now have a compelling solution that combines the strengths of both global and local platforms, making Salesforce a winning choice for businesses operating in the region.

It can help brands elevate existing foundational structures (i.e., private traffic setups) to new heights to deliver even more personalized and engaging customer experiences efficiently throughout their journey.

Keep in mind that Salesforce China version is different from the Salesforce global one, requiring customized integrations and tailored strategies that fit the local market.

Discover how Salesforce and Alibaba can help brands drive sales and foster customer loyalty in China with a comprehensive CRM that connects all major local touchpoints and business systems and with the global CRM.